salt tax limit repeal

The Tax Foundation estimates a full repeal of the SALT deduction limit may reduce federal revenue by 380 billion through 2025 when the provision will sunset. March 1 2022 600 AM 5 min read.

11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state.

. Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure. 11 rows The TCJA also repealed the Pease limitation for tax years 2018 through 2025. Raising or repealing the 10000 limit on the SALT deduction a change imposed by the 2017 Republican tax overhaul is one of the most politically charged aspects of the negotiation.

House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031. The 10000 cap would in theory resume in 2024 and 2025. To change the deduction limit for state and local taxes.

The on-and-off cap. Some House Democrats have threatened to block Build Back Better if the broken-up package drops relief for the 10000 limit on the federal deduction for state and local taxes known as SALT. Peter King R-NY introduced a bill in the House of Representatives to repeal the 10000 cap on the state and local deduction SALT.

Blocking Threat Suozzi known as Mr. The higher SALT deduction limit would be financed by an increase in the top marginal income tax rate from 37 to 396 the rate that existed before passage of the 2017 tax cut legislation but. Finally the TCJA.

The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus. Americans who rely on the state and local tax SALT deduction at. Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on.

Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. California Passes SALT Cap Work-Around. Heres how Democrats plans affect Americans with big state and local tax bills.

SALT for his dedication to the issue said there are enough Democrats who will block the entire bill if the measure is not addressed. And since the Tax Cuts and Jobs Act of 2017 filers who itemize deductions cant claim more than 10000 for SALT increasing levies for. Most state PTET elections follow the standard workaround formula for the SALT cap which was introduced under the 2017 Tax.

Many Democrats from high-tax states. The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction. 1 but no later than March 15 of the tax yearie by March 15 2022 for the 2022 tax year.

A group of Democrats from high-tax states like New Jersey and New York has been pushing for months to include a full repeal of the Trump-era limit on state and local tax deductions as part of. The chief similarities between the SALT deduction limit and the CTC expansion are that both have run up against President Bidens 400000 pledge and encountered non-trivial intraparty head. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

The elective tax does not have an expiration date concurrent with the sunset of the federal SALT cap. As discussed in Part I of this article at least 22 states have adopted a pass-through entity taxor PTETelection for small business owner taxpayers seeking to avoid the 10000 federal deduction limit for state and local taxes. The period to opt-in to the New York PTET has ended for tax year 2021 but for tax years 2022 and later an eligible entity may opt in on or after Jan.

July 29 2021. The plan reportedly would repeal the SALT cap for 2022 and 2023 only. Under the 2017 Tax Cuts and Jobs Act TCJA.

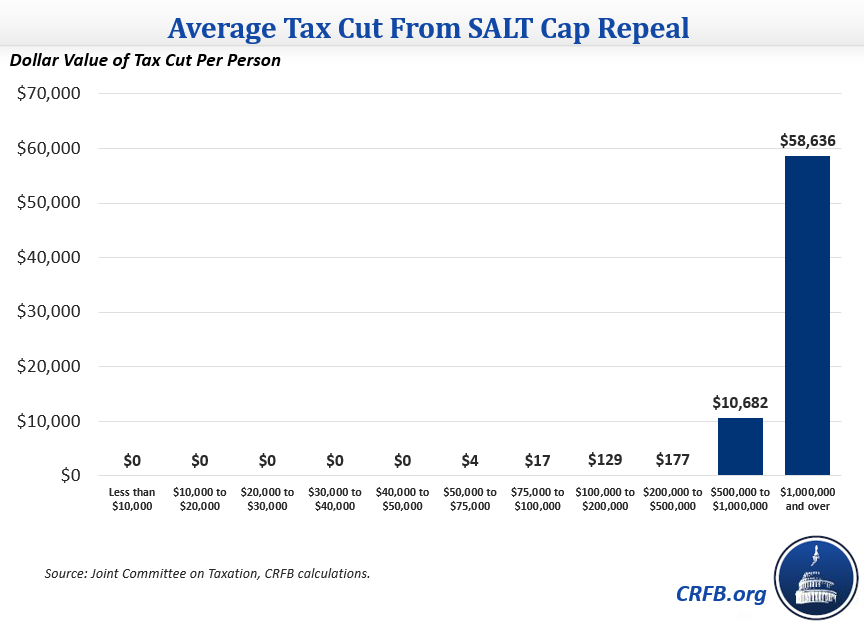

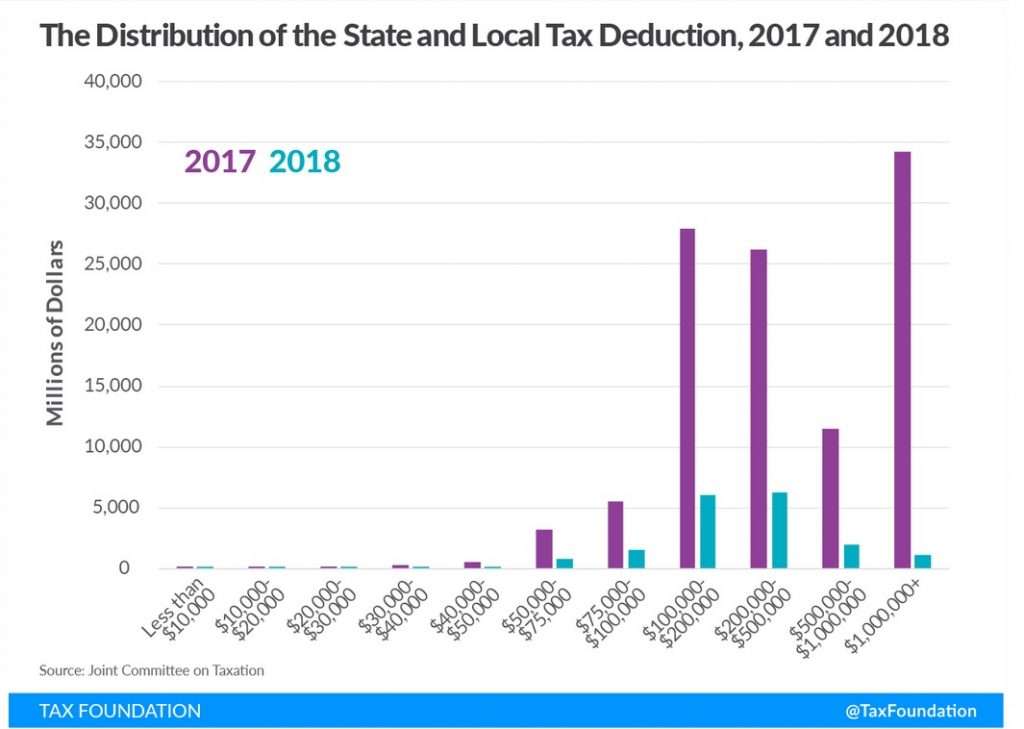

The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax. Most people do not qualify to itemize The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or local governments. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year.

SALT Repeal Just Below 1 Million is Still Costly and Regressive. While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step toward allowing many of its. However the bill stalled in December.

Nita Lowey D-NY and Rep. Meanwhile a growing number of states.

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

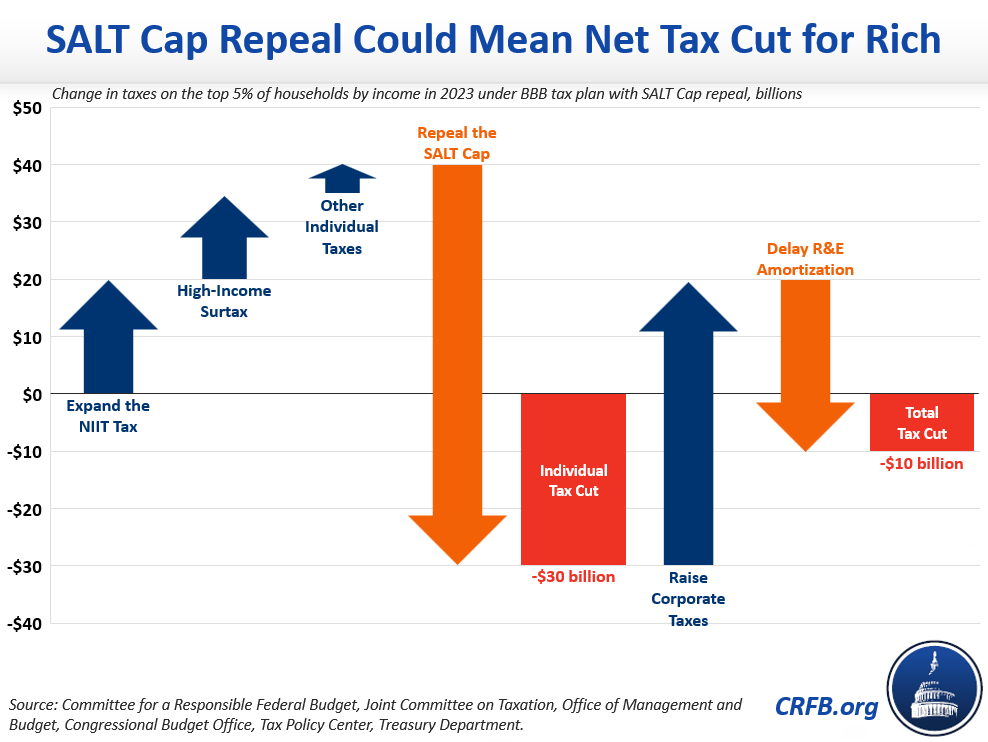

Reconciliation May Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

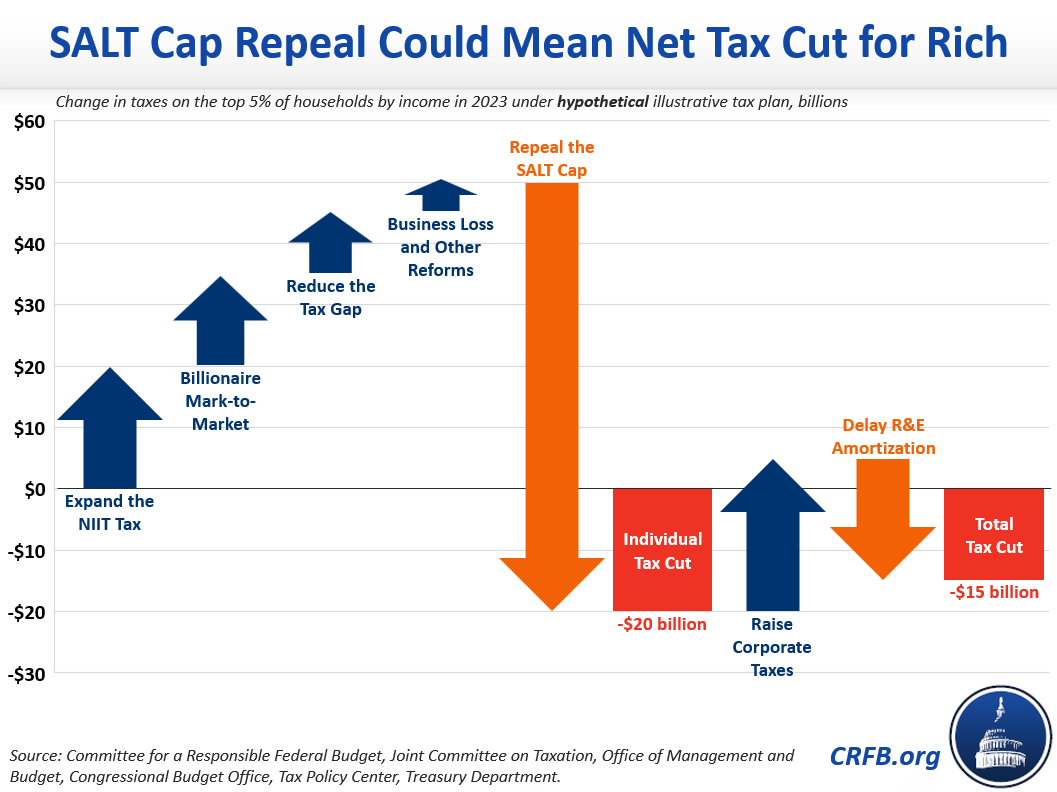

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Could Reconciliation Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

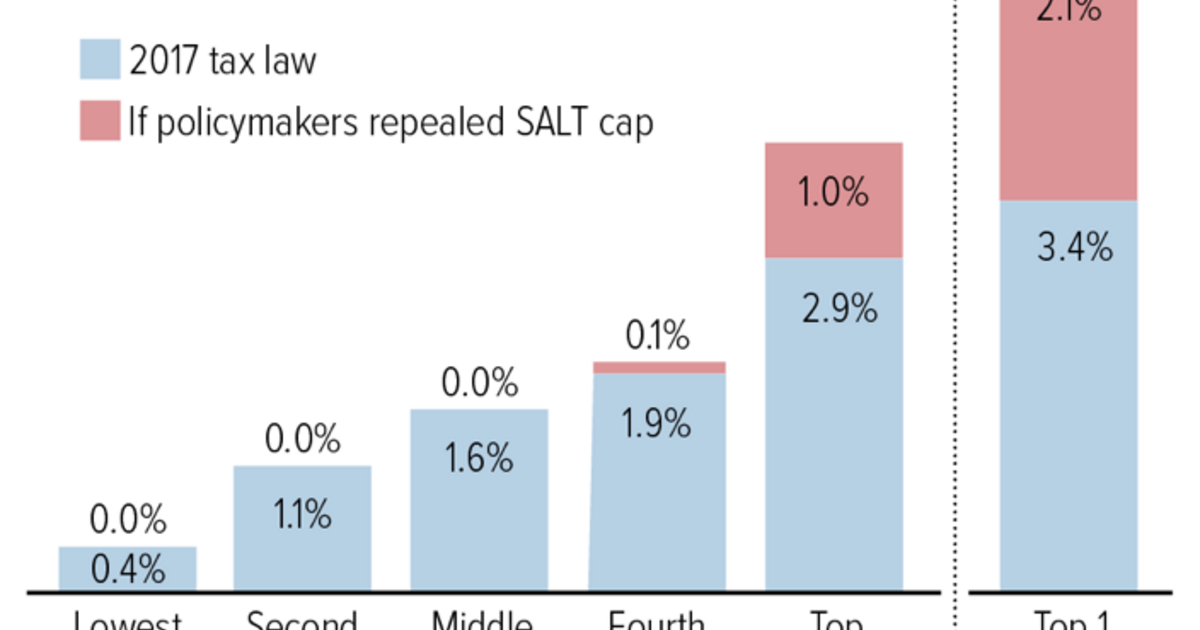

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Eat The Rich House Democrats Plan To Pass Huge Tax Break For Wealthy Homeowners

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg